How I Turned Massage Costs into a Smarter Investment Cycle

What if your monthly massage wasn’t just self-care—but part of a smarter financial strategy? I used to see it as a guilty pleasure, until I reframed it within my investment cycle. By treating personal wellness as a long-term asset, not just an expense, I found ways to balance spending with growth. This shift didn’t just ease my stress—it improved my financial focus. Let me walk you through how a simple rethink transformed both my budget and my health.

The Hidden Cost of Ignoring Self-Care

Many people treat personal wellness as an optional line item, something to cut when budgets tighten. But this mindset overlooks a critical truth: neglecting self-care often leads to far greater financial consequences down the road. Chronic stress, untreated muscle tension, and poor sleep don’t just diminish quality of life—they translate into missed workdays, increased medical visits, and reduced productivity. Consider a working mother who skips regular care to save money, only to later face a doctor’s visit for tension-related headaches or a week off due to burnout. The short-term savings are quickly erased by unexpected costs and lost income. These scenarios are not rare; they are common patterns in households where wellness is seen as a luxury rather than a necessity.

When we reframe regular massage therapy as preventive care, its value becomes clearer. Just as routine car maintenance prevents costly repairs, consistent bodywork can reduce the likelihood of developing chronic pain or stress-related conditions. Studies have shown that individuals who engage in regular stress-reducing practices report fewer sick days and lower healthcare utilization over time. While massage is not a substitute for medical treatment, it plays a supportive role in maintaining physical resilience. For many, the monthly session isn’t indulgence—it’s a calculated investment in sustained functionality. By viewing it through this lens, families can begin to prioritize wellness not as an extra, but as a foundational element of financial health.

This shift in perspective is especially powerful for women between 30 and 55, who often juggle caregiving, careers, and household management. The pressure to do everything can lead to chronic exhaustion, which in turn affects decision-making, energy levels, and overall performance. When health declines, so does earning potential. Recognizing that small, consistent wellness expenses can prevent larger disruptions allows for smarter long-term planning. It’s not about spending more—it’s about spending with intention, aligning personal care with financial stability.

Reframing Expenses: From Drain to Investment

Not all expenses are created equal. In personal finance, we often categorize spending as either 'needs' or 'wants,' but this binary overlooks a third category: investments in human capital. Human capital refers to the economic value of a person’s skills, knowledge, and physical well-being. When you maintain your body and mind, you preserve and enhance your ability to earn, adapt, and grow financially. A massage, when viewed as part of this maintenance cycle, is not a drain on resources—it’s a strategic input that supports long-term output.

Think of your body as the engine of your financial life. Just as a business invests in equipment upkeep to ensure smooth operations, you must invest in your own physical sustainability. Skipping tune-ups may save money today, but over time, performance declines and breakdowns become more likely. A stiff neck or chronic back pain can reduce concentration at work, slow response times, and even limit job mobility. These subtle impairments accumulate, affecting promotions, side gigs, or entrepreneurial efforts. By contrast, regular bodywork helps maintain range of motion, reduces inflammation, and improves circulation—all of which contribute to better daily functioning.

The psychological benefits are equally important. Stress hormones like cortisol, when elevated over time, impair memory, decision-making, and emotional regulation. These cognitive effects directly impact financial choices—leading to impulsive spending, poor investment timing, or avoidance of necessary budgeting conversations. Massage has been shown to reduce cortisol levels and increase serotonin and dopamine, creating a calmer mental state. This clarity translates into better financial discipline. When you feel balanced, you’re more likely to stick to a savings plan, negotiate a raise, or research investment options thoughtfully.

Reframing massage as an investment also changes how we evaluate its cost. Instead of asking, 'Can I afford this?' we begin to ask, 'Can I afford not to do this?' The answer, for many, is no. Over time, the compounding effect of consistent wellness practices leads to fewer health crises, stronger work performance, and greater personal resilience—all of which support financial progress. This is not about justifying luxury; it’s about recognizing that some forms of spending actually generate returns in the form of improved capacity, focus, and longevity.

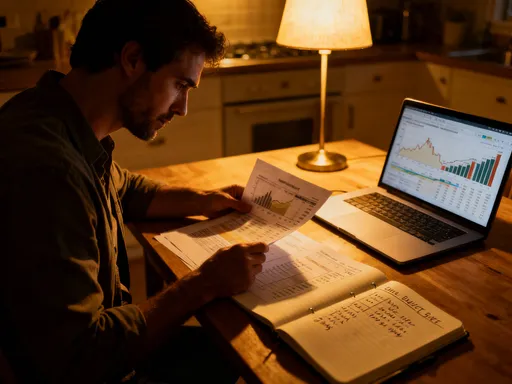

Mapping the Investment Cycle with Wellness in Mind

The traditional financial investment cycle consists of four phases: earning, saving, investing, and protecting. Each stage builds on the previous one, creating a structured path toward long-term wealth. Yet, this model often leaves out a crucial element: the role of personal wellness in enabling and sustaining each phase. When your body and mind are depleted, every step of the cycle becomes harder. You earn less because you’re too tired to pursue advancement. You save less because decision fatigue leads to overspending. You invest poorly because stress clouds judgment. And you protect inadequately because burnout reduces vigilance.

Now imagine integrating wellness into this cycle. During the earning phase, regular massage helps maintain energy, focus, and posture—especially important for those working long hours or managing physical demands at home. Improved physical comfort leads to better work quality, fewer absences, and increased confidence in professional settings. This, in turn, opens doors to raises, bonuses, or new opportunities. In the saving phase, a calm mind is more capable of delayed gratification. When stress is managed, the urge to spend on comfort purchases—like takeout, retail therapy, or convenience services—diminishes. You’re more likely to stick to a budget when your nervous system isn’t in survival mode.

When it comes to investing, mental clarity is essential. Market fluctuations require steady nerves and rational analysis. Someone operating under chronic stress may panic-sell during downturns or chase risky trends out of desperation. But with consistent self-care, emotional regulation improves, allowing for more disciplined, long-term investment behavior. You’re more likely to rebalance a portfolio calmly or hold through volatility when your baseline stress is low. Finally, in the protection phase—insurance, estate planning, risk management—wellness plays a preventive role. A healthy person is less likely to face sudden medical bills or disability, reducing the need for reactive financial measures.

Visualize this cycle with wellness at its center, supporting each stage like a pillar. The monthly massage isn’t an outlier; it’s a recurring input that strengthens the entire system. By aligning self-care with financial rhythm, you create a more sustainable, resilient model of wealth building. This integration doesn’t require dramatic changes—it starts with recognizing that your body is not separate from your finances, but central to them.

Practical Budgeting: Making Room Without Cutting Corners

One of the most common objections to regular wellness spending is, 'I can’t afford it.' But in most cases, the issue isn’t income—it’s allocation. Many households have room in their budgets for meaningful wellness investments if they reevaluate low-impact expenses. The key is not to add more strain, but to redirect existing spending toward higher-value activities. A detailed budget audit can reveal surprising opportunities to free up funds without sacrificing comfort or stability.

Take the case of a 42-year-old mother of two who earns a stable income but feels she can’t justify monthly massages. After tracking her spending for three months, she discovered she was paying for a premium streaming service she rarely used, ordering takeout an average of four times a week, and buying coffee from a café every morning. Together, these habits totaled over $300 per month—more than the cost of biweekly massage sessions. By canceling one subscription, switching to home-brewed coffee, and limiting takeout to once a week, she freed up $220. She used $120 to cover monthly massage appointments and put the remaining $100 into a short-term savings fund for future wellness goals, such as a yoga retreat or ergonomic home office upgrades.

This reallocation didn’t require earning more or living with less—it simply required intentionality. The savings came not from deprivation, but from shifting priorities. The takeout meals she cut were often eaten hastily while managing household tasks, offering little enjoyment. The daily coffee run was more habit than necessity. In contrast, the massage became a dedicated time for restoration, improving her sleep, reducing headaches, and increasing her patience with family demands. The financial trade-off was clear: she exchanged low-value, automatic spending for high-impact, deliberate investment.

Other common budget leaks include unused gym memberships, duplicate software subscriptions, and impulse online purchases. Many families also overspend on convenience services—laundry drop-offs, grocery delivery fees, or frequent school pickup snacks—that add up silently. By identifying just one or two of these areas, most households can redirect $100–$200 per month toward wellness without financial strain. The goal isn’t perfection—it’s progress. Even a single monthly session, consistently maintained, can yield measurable benefits in energy, mood, and focus, which in turn support better financial decisions across the board.

Risk Control: Avoiding the Burnout Trap

Financial setbacks are often attributed to external factors—market downturns, job loss, or unexpected expenses. But one of the most overlooked sources of financial risk is internal: personal burnout. Burnout is not just emotional fatigue; it’s a state of physical and mental exhaustion that impairs judgment, reduces productivity, and increases vulnerability to illness. When burnout occurs, it doesn’t just affect well-being—it disrupts the entire financial ecosystem. Missed deadlines, poor work performance, and disengagement can lead to stalled promotions, reduced hours, or even job loss. Medical visits for stress-related conditions add further strain.

Preventing burnout is not a luxury—it’s a core risk management strategy. Just as homeowners insure their property or investors diversify their portfolios, individuals must protect their most valuable asset: themselves. Regular massage therapy serves as a form of non-invasive, proactive care that helps regulate the nervous system, release muscle tension, and improve sleep quality. These benefits may seem subtle, but their cumulative effect is significant. A body that is physically relaxed is less likely to succumb to the inflammatory effects of chronic stress, which are linked to a host of long-term health issues, including hypertension and weakened immunity.

From a financial standpoint, avoiding burnout means maintaining consistent income and avoiding costly recovery periods. Consider the woman who pushes through months of overwork, only to require weeks off due to adrenal fatigue. The lost wages, combined with potential medical costs, represent a far greater financial hit than the cost of regular preventive care. Moreover, burnout often leads to reactive spending—on sleep aids, quick meals, or emergency childcare—as coping mechanisms. These expenses compound the initial loss.

By contrast, a structured wellness routine creates a buffer against collapse. Weekly or monthly massage sessions act as checkpoints, offering both physical relief and mental reset moments. They signal to the body and mind that rest is not optional—it’s part of the system. This approach aligns with the principle of risk mitigation in finance: small, consistent investments today prevent large, unpredictable losses tomorrow. When you prioritize recovery, you’re not spending money—you’re insuring your earning capacity.

Scaling the Strategy: From One Massage to Long-Term Gains

Once the habit of regular wellness spending is established, the benefits begin to compound. Improved physical comfort leads to better sleep, which enhances cognitive function. Sharper focus increases work efficiency, making it easier to complete tasks, meet goals, and take on new responsibilities. Sustained energy opens the door to side projects, freelance work, or career advancement. Over time, these small advantages accumulate into measurable financial gains.

Consider a woman who begins monthly massage therapy and notices, within a few months, that her chronic lower back pain has diminished. As a result, she sleeps more soundly, feels less irritable during the day, and has more patience with her children and coworkers. Her improved mood and stamina allow her to volunteer for a high-visibility project at work. She completes it successfully, catching the attention of leadership. Six months later, she receives a promotion with a 15% salary increase. While the massage didn’t directly cause the promotion, it played a supporting role by improving her physical resilience and mental clarity—key factors in her ability to perform under pressure.

This is the power of compounding wellness. Each session contributes to a stronger baseline of health, which in turn supports greater professional and financial opportunities. The return on investment isn’t immediate, but it is real. Over five years, that 15% raise could amount to tens of thousands in additional income. When viewed in this light, the cost of massage becomes a fraction of the gain. And the cycle continues: higher income allows for increased wellness investment, which further enhances performance, creating a positive feedback loop between health and wealth.

This principle extends beyond the workplace. With better energy and focus, individuals are more likely to engage in financial planning, research investment options, or start a small business. They have the mental bandwidth to compare insurance policies, optimize retirement contributions, or negotiate better rates on household expenses. Wellness doesn’t just support financial health—it enables it. The more stable your physical and emotional foundation, the more capable you are of making strategic, long-term decisions that build lasting wealth.

The Bigger Picture: Sustainable Wealth Starts with You

True financial success is not measured solely by account balances or investment returns. It is defined by sustainability—the ability to maintain stability, enjoy life, and adapt to change over time. A large portfolio means little if poor health prevents you from enjoying it. A high income loses value if constant stress erodes your relationships and well-being. Sustainable wealth requires balance, and that balance begins with how you treat yourself.

The best investment you can make is not in stocks, real estate, or retirement funds alone—it is in your own physical and mental resilience. When you prioritize wellness, you are not spending money; you are fortifying the foundation of your financial life. Every massage, every yoga class, every quiet walk is a deposit into your long-term capacity to earn, save, and thrive. These choices may seem small, but their cumulative effect shapes the trajectory of your entire financial journey.

For women in their 30s, 40s, and 50s—who often place others’ needs before their own—this shift in mindset is revolutionary. It redefines self-care not as selfishness, but as stewardship. You are not just managing a household or a career; you are managing a life. And that life is the engine of every financial decision you make. By treating wellness as a core component of financial planning, you create a more resilient, adaptable, and fulfilling model of success. The cycle of investment no longer revolves around external markets alone—it centers on you, the most valuable asset of all.